Offshore Company Formation: Your Pathway to International Success

Offshore Company Formation: Your Pathway to International Success

Blog Article

Techniques for Cost-Effective Offshore Firm Development

When taking into consideration offshore business development, the quest for cost-effectiveness ends up being an extremely important issue for organizations seeking to broaden their procedures internationally. In a landscape where financial carefulness reigns supreme, the techniques used in structuring overseas entities can make all the difference in achieving monetary performance and functional success. From browsing the complexities of jurisdiction selection to carrying out tax-efficient frameworks, the trip in the direction of establishing an offshore presence is swarming with difficulties and chances. By exploring nuanced techniques that mix legal compliance, economic optimization, and technological improvements, organizations can embark on a path towards offshore company formation that is both financially sensible and purposefully audio.

Choosing the Right Territory

When establishing an offshore firm, picking the proper jurisdiction is a crucial decision that can dramatically affect the success and cost-effectiveness of the formation procedure. The territory chosen will certainly figure out the regulatory framework within which the firm runs, impacting taxation, reporting demands, privacy laws, and total organization flexibility.

When picking a jurisdiction for your overseas firm, numerous aspects need to be thought about to guarantee the decision lines up with your calculated goals. One vital aspect is the tax regimen of the territory, as it can have a substantial effect on the business's profitability. In addition, the level of governing compliance called for, the political and economic stability of the territory, and the ease of working has to all be evaluated.

Furthermore, the credibility of the jurisdiction in the worldwide company neighborhood is vital, as it can affect the perception of your company by clients, partners, and banks - offshore company formation. By thoroughly examining these aspects and looking for expert advice, you can choose the right territory for your offshore business that enhances cost-effectiveness and supports your company purposes

Structuring Your Company Effectively

To guarantee optimal performance in structuring your offshore business, careful interest must be offered to the business framework. The very first step is to specify the company's ownership framework plainly. This consists of establishing the officers, directors, and shareholders, along with their duties and roles. By establishing a transparent ownership framework, you can make sure smooth decision-making procedures and clear lines of authority within the firm.

Following, it is vital to think about the tax ramifications of the selected framework. Various territories use differing tax obligation advantages and incentives for offshore business. By carefully evaluating the tax laws and guidelines of the picked territory, you can enhance your business's tax effectiveness and reduce unnecessary expenses.

Furthermore, maintaining correct paperwork and documents is important for the efficient structuring of your overseas company. By keeping precise and up-to-date documents of monetary purchases, corporate choices, and conformity documents, you can make sure transparency and responsibility within the organization. This not just helps with smooth procedures but likewise assists in demonstrating compliance with regulatory demands.

Leveraging Innovation for Financial Savings

Reliable structuring of your overseas company not only hinges on precise interest to organizational structures however additionally on leveraging modern technology for financial savings. One way to leverage technology for savings in offshore company formation is by utilizing cloud-based services for data storage and collaboration. By integrating modern technology tactically right into your overseas business development process, you can attain substantial financial savings while boosting functional performance.

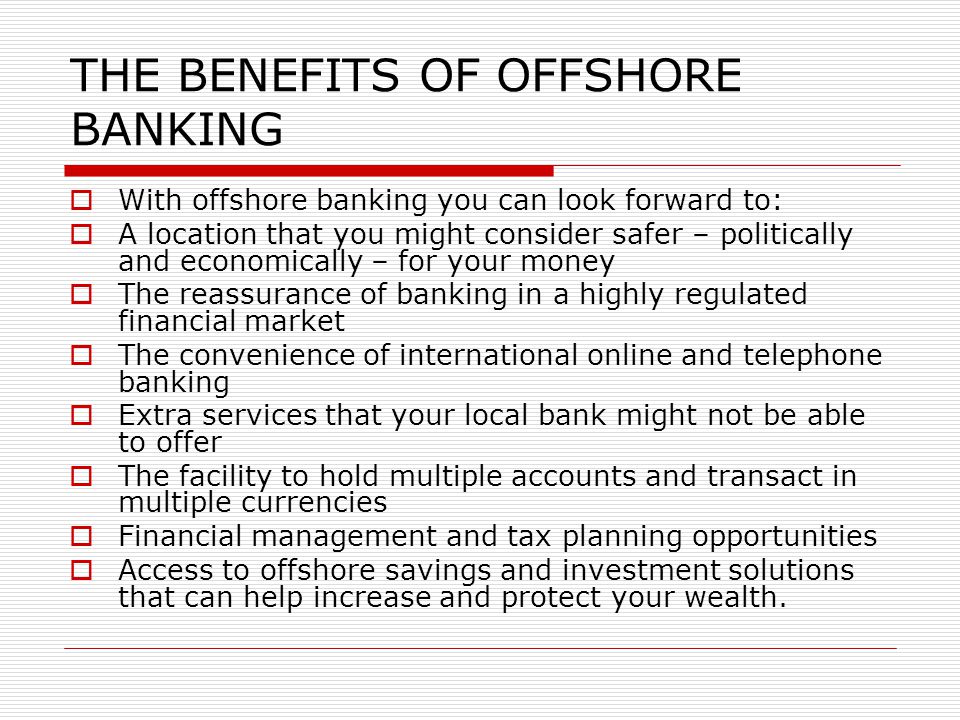

Lessening Tax Obligation Obligations

Using calculated tax planning techniques can efficiently reduce the financial burden of tax obligation responsibilities for overseas business. One of one of the most typical techniques for reducing tax obligation responsibilities is with profit shifting. By dispersing revenues to entities in low-tax jurisdictions, overseas business can legally decrease their general tax commitments. Furthermore, benefiting from tax motivations and exemptions offered by the territory where the overseas company is signed up can lead to substantial financial savings.

An additional method to decreasing tax responsibilities is by structuring the offshore business in a tax-efficient manner - offshore company formation. This includes carefully creating the possession and operational structure to enhance tax advantages. As an example, establishing a holding firm in a jurisdiction with desirable tax legislations can aid consolidate revenues and lessen tax obligation direct exposure.

Moreover, remaining upgraded on global tax policies and compliance demands is critical for reducing tax liabilities. By guaranteeing stringent adherence to tax obligation legislations and laws, overseas firms can avoid expensive charges and tax obligation conflicts. Seeking expert recommendations from tax experts or legal experts specialized in global tax obligation issues can additionally give useful understandings into efficient tax obligation preparation strategies.

Guaranteeing Compliance and Risk Reduction

Applying durable compliance steps is vital for offshore companies to mitigate threats and preserve regulatory adherence. Offshore jurisdictions usually encounter boosted examination due to concerns concerning money site web laundering, tax obligation evasion, and various other financial crimes. To make certain conformity and reduce risks, overseas companies should carry out complete due diligence on customers and service partners to avoid involvement in illicit tasks. Additionally, implementing Know Your Client (KYC) and Anti-Money Laundering (AML) procedures can assist validate the legitimacy of deals and guard the business's track record. Normal audits and evaluations of financial records are essential to determine any abnormalities or non-compliance problems promptly.

Additionally, remaining abreast of transforming regulations and legal demands is essential for offshore companies to adapt their conformity techniques accordingly. Engaging legal professionals or conformity consultants can offer useful advice on browsing intricate regulatory landscapes and making sure adherence to international standards. By prioritizing compliance and danger mitigation, overseas companies can improve transparency, build count on with stakeholders, and secure their procedures from check that possible lawful effects.

Verdict

Using calculated tax obligation preparation strategies can properly reduce the financial concern of tax obligations for offshore business. By distributing profits to entities in low-tax jurisdictions, overseas firms can More Bonuses legally reduce their general tax commitments. Furthermore, taking advantage of tax obligation rewards and exceptions used by the territory where the offshore business is registered can result in substantial savings.

By guaranteeing strict adherence to tax laws and laws, overseas business can prevent costly penalties and tax obligation disagreements.In verdict, economical overseas company formation calls for cautious consideration of jurisdiction, reliable structuring, modern technology use, tax minimization, and conformity.

Report this page